Financial accounting for decision makers 3e delves into the intricacies of financial reporting and analysis, providing invaluable insights for informed decision-making. This comprehensive guide unveils the fundamental principles and applications of financial accounting, empowering readers to navigate the complex financial landscape with confidence and clarity.

Through a meticulous exploration of financial statements, budgeting, forecasting, and risk assessment, this book equips readers with the tools and techniques necessary to make sound financial decisions that drive organizational success.

Overview of Financial Accounting for Decision Makers

Financial accounting provides crucial information to decision-makers to assess a company’s financial performance, position, and cash flows. It helps them make informed decisions about investments, financing, operations, and other aspects of business.

Key concepts include the accrual basis of accounting, matching principle, and going concern assumption. Financial accounting follows established principles and standards to ensure consistency and reliability of information.

Financial accounting information is used in decision-making processes such as budgeting, capital budgeting, dividend policy, and risk assessment.

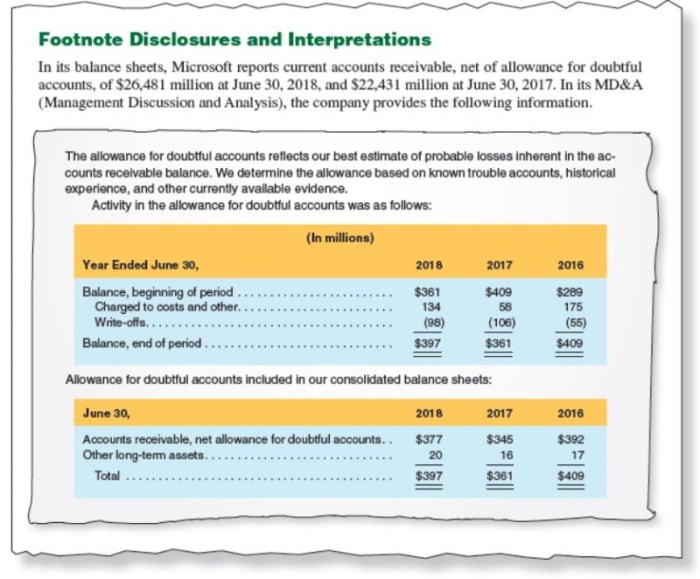

Financial Statements and Analysis

Balance Sheet, Financial accounting for decision makers 3e

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It shows assets, liabilities, and equity, providing insights into the company’s resources, obligations, and ownership structure.

Income Statement

The income statement summarizes a company’s financial performance over a period of time. It shows revenues, expenses, and net income, providing information about the company’s profitability and operating efficiency.

Cash Flow Statement

The cash flow statement shows the sources and uses of cash over a period of time. It categorizes cash flows into operating, investing, and financing activities, providing insights into the company’s liquidity and cash management.

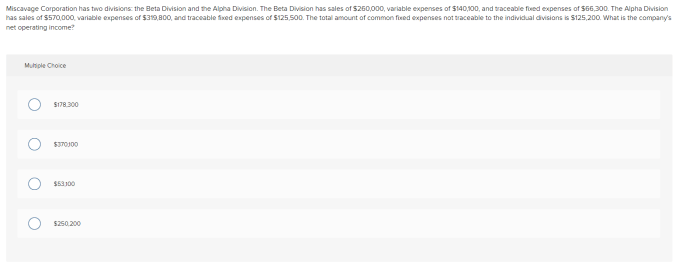

Financial Analysis

Financial analysis involves examining financial statements to assess a company’s financial health. Key ratios and metrics used include liquidity ratios, profitability ratios, and solvency ratios.

Budgeting and Forecasting

Budgeting involves creating a plan for future financial operations, while forecasting is predicting future financial performance. Both are essential for decision-making as they help businesses plan and prepare for future scenarios.

Budgeting involves setting financial targets, allocating resources, and controlling expenses. Forecasting involves using historical data, trends, and assumptions to estimate future financial performance.

Common budgeting and forecasting methods include zero-based budgeting, incremental budgeting, and trend analysis.

Cost-Benefit Analysis: Financial Accounting For Decision Makers 3e

Cost-benefit analysis is a technique used to evaluate the potential costs and benefits of a decision or project. It helps decision-makers assess whether the benefits outweigh the costs.

Steps involved in cost-benefit analysis include identifying alternatives, quantifying costs and benefits, comparing alternatives, and making a decision.

Cost-benefit analysis is used in a variety of decision-making contexts, such as capital budgeting, project evaluation, and policy analysis.

Risk Assessment and Management

Risk assessment involves identifying and evaluating potential risks that a business may face. Risk management involves developing and implementing strategies to mitigate or minimize these risks.

Types of risks faced by businesses include financial risk, operational risk, and reputational risk.

Risk assessment and management methods include risk identification, risk analysis, and risk mitigation strategies.

Ethical Considerations in Financial Decision Making

Ethical considerations are important in financial decision-making as they ensure transparency, accountability, and fairness.

Ethical principles include honesty, integrity, objectivity, and due care. Decision-makers should consider the impact of their decisions on stakeholders, society, and the environment.

Ethical dilemmas may arise in situations such as conflicts of interest, insider trading, and financial reporting fraud.

FAQ Resource

What are the key benefits of financial accounting for decision makers?

Financial accounting provides decision makers with a comprehensive understanding of a company’s financial performance, enabling them to make informed decisions that maximize profitability and minimize risks.

How does financial accounting contribute to effective budgeting and forecasting?

Financial accounting provides historical data and insights that serve as a foundation for developing realistic budgets and forecasts, ensuring efficient resource allocation and mitigating financial uncertainties.

What role does risk assessment play in financial decision-making?

Risk assessment helps decision makers identify and evaluate potential financial risks, enabling them to develop strategies to mitigate or avoid these risks and safeguard the organization’s financial well-being.