Which descriptor relates to the income approach for valuing corporations? This question lies at the heart of corporate valuation, a complex and multifaceted field that seeks to determine the worth of a company. The income approach, one of the three primary valuation methods, stands out for its focus on a company’s future earnings potential.

In this exploration, we will delve into the intricacies of the income approach, examining its key assumptions, limitations, and applications.

The income approach rests on the fundamental principle that the value of a corporation is directly tied to its ability to generate income. By projecting future earnings and applying appropriate capitalization or discount rates, analysts can derive an estimate of a company’s intrinsic value.

This approach is particularly useful when valuing companies with stable or predictable cash flows, as it provides a forward-looking perspective on the company’s earning power.

1. Income Approach for Valuing Corporations

The income approach is a valuation method that uses a company’s future income streams to determine its value. It assumes that the value of a corporation is equal to the present value of its future cash flows.

The key assumptions of the income approach are that the company’s future cash flows are predictable and that the discount rate used to present value these cash flows is appropriate.

The limitations of the income approach are that it is difficult to predict future cash flows accurately and that the discount rate used can be subjective.

2. Capitalization of Earnings Method

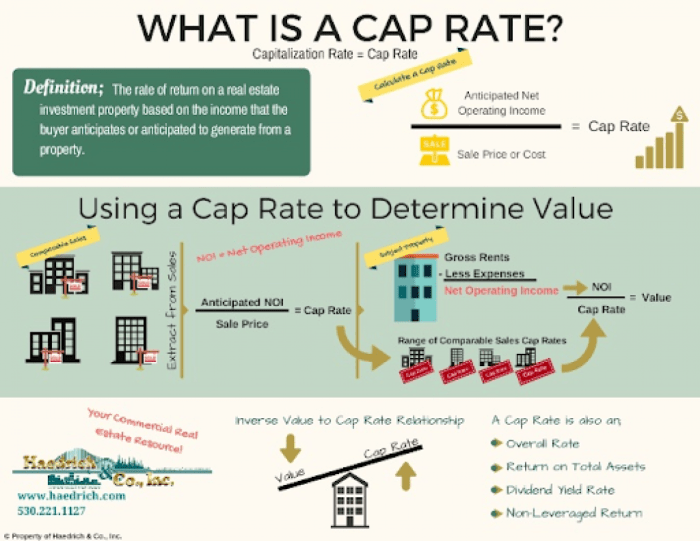

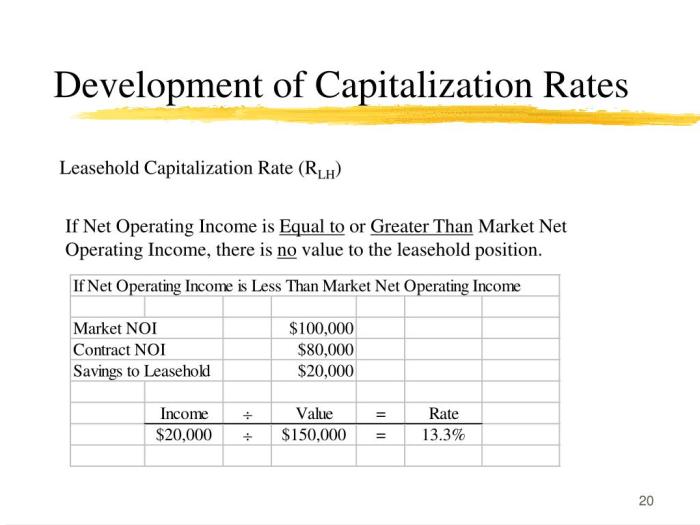

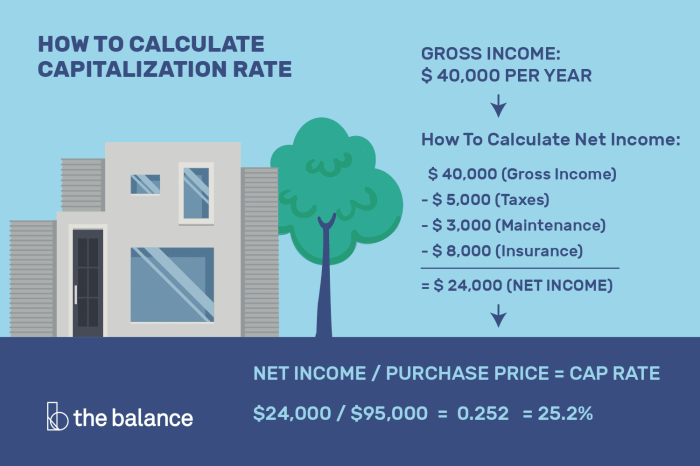

The capitalization of earnings method is a simplified version of the income approach that uses a company’s historical earnings to determine its value.

The capitalization rate used in this method is typically based on the company’s industry and risk profile.

The formula for calculating the value of a corporation using the capitalization of earnings method is:

Value = Earnings / Capitalization Rate

3. Discounted Cash Flow Method

The discounted cash flow method is a more complex version of the income approach that uses a company’s projected future cash flows to determine its value.

The steps involved in using the discounted cash flow method are:

- Project the company’s future cash flows.

- Discount the projected cash flows back to the present using a discount rate.

- Sum the discounted cash flows to arrive at the value of the corporation.

4. Comparison with Other Valuation Methods, Which descriptor relates to the income approach for valuing corporations

The income approach is often compared to the market approach and the asset approach.

The market approach uses comparable companies to determine the value of a corporation. The asset approach uses the value of a company’s assets to determine its value.

The income approach is generally considered to be more accurate than the market approach and the asset approach, but it is also more complex.

5. Applications of the Income Approach

The income approach is used in a variety of valuation contexts, including:

- Mergers and acquisitions

- Initial public offerings

- Estate planning

- Taxation

FAQ Guide: Which Descriptor Relates To The Income Approach For Valuing Corporations

What are the key assumptions of the income approach?

The income approach assumes that future earnings are a reliable indicator of a company’s value, that the company will continue to operate as a going concern, and that there is a stable relationship between earnings and market value.

What are the limitations of the income approach?

The income approach can be limited by the accuracy of earnings projections, the difficulty in estimating appropriate capitalization or discount rates, and the potential for earnings manipulation.

When is the income approach most appropriate?

The income approach is most appropriate for valuing companies with stable or predictable cash flows, such as utilities, real estate investment trusts, and other companies with recurring revenue streams.